Be Debt Free Today…Budgeting Solutions for Personal Finance

Do you want to be debt free today? If you have the money in the bank, of course, you can pay off all of your bills. However, for most of us, being debt free today is more of a mentality than a reality.

Being debt free today means no mortgage, no auto loans, and no credit card bills. It means that everything you earn goes into your pocket for spending this month or for saving for the future.

In today’s consumer culture, that doesn’t seem likely for most people. In fact, most Americans dig themselves deeper in debt each and every month.

One of the interesting things that have happened in the most recent decades, is that consumers have been more responsible. For the last 10 years both technology and the economy have caused people to shop more effectively. How many times have you gone into a store and then checked prices on Amazon? With the spike in health care costs with declining coverages, many families now look for ways to reduce costs through online apps for both medical care and prescriptions.

While we have seen an economic recovery over the last decade after the recession of 2008–2010, people have fallen back into some of the bad habits that they did prior to the economic downturn. People are once again assuming that real estate prices will always go up. They are buying houses that stretch their budgets and make them “house poor”.

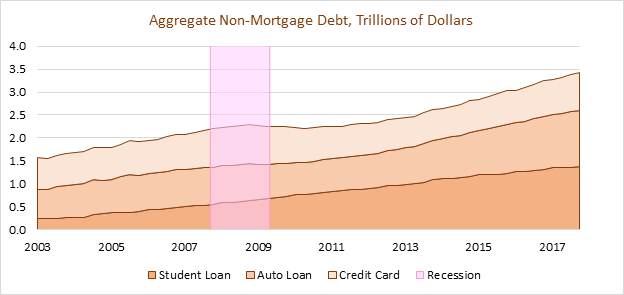

But it is not just the home market that has seen irrational exuberance. In the last decade, debt levels have been rising at an alarming rate. As people have felt more comfortable with low unemployment and economic recovery they have also been buying more and more on credit.

Source: http://www.aspenepic.org/plummeting-savings-rising-debt-red-flags-household-finances/

We will eventually see another economic downturn that will strain family finances. While the economy is performing well, it is time to get your finances in order and completely eliminate debt from your life.

The first thing you should do is make a budget on two pieces of paper. The first page “A” should include all of the things you have to pay. Be judicious on this page. The “A” page should include non-negotiable items such as your house payment, credit card loans, car loans, etc.

You will also include the things you absolutely need on the “A” page. For instance, you have to have food to live. But, how much do you have to spend on food? In reality, you probably can find ways to feed your family on a lot less money. Eating out is not an “A” item. Steaks are not an “A” item.

Clothing is another area where you can save money. While you need basic clothing, thrift store prices find their way into your “A” budget whereas designer jeans go on the “B” page.

Your “B” page includes all of the extras. You may find that there’s not a lot left over for the “B” page at first when you are trying to live debt free today. But, over time, you will find that you can afford more things on the “B” page.

When you get a bonus at work, you can add it to the items on the “B” page. When you get a tax refund, it can go to “B” items. Any increases in salary or second jobs can fund “B” projects.

If you want some of the items on the “B” page, you can create a side business that can help to fund some of these items, however, the longer that you go without them you may find that they are not as important as you thought.

If you are serious about living debt free today, you will take a careful look at your budget. You don’t have to buy into the consumer culture that plagues America. You can chart your own course. In other words, you can be debt free today.

Jeff Kikel is the Freedom Guide. Jeff has been a Wealth Manager for over 25 years and works with both Individuals and Small Business Owners helping them reach their Freedom Day(™), the first day that they wake up and have a work optional lifestyle. Jeff is a published author, in-demand speaker, blogger, and the host of Freedom Nation Podcast.