5 Key Traits For Being a Business Survivor

One of the things that makes me laugh most is the number of people who know me and say that I am "lucky to be so successful in my businesses." The reason I laugh is that it has absolutely nothing to do with luck.

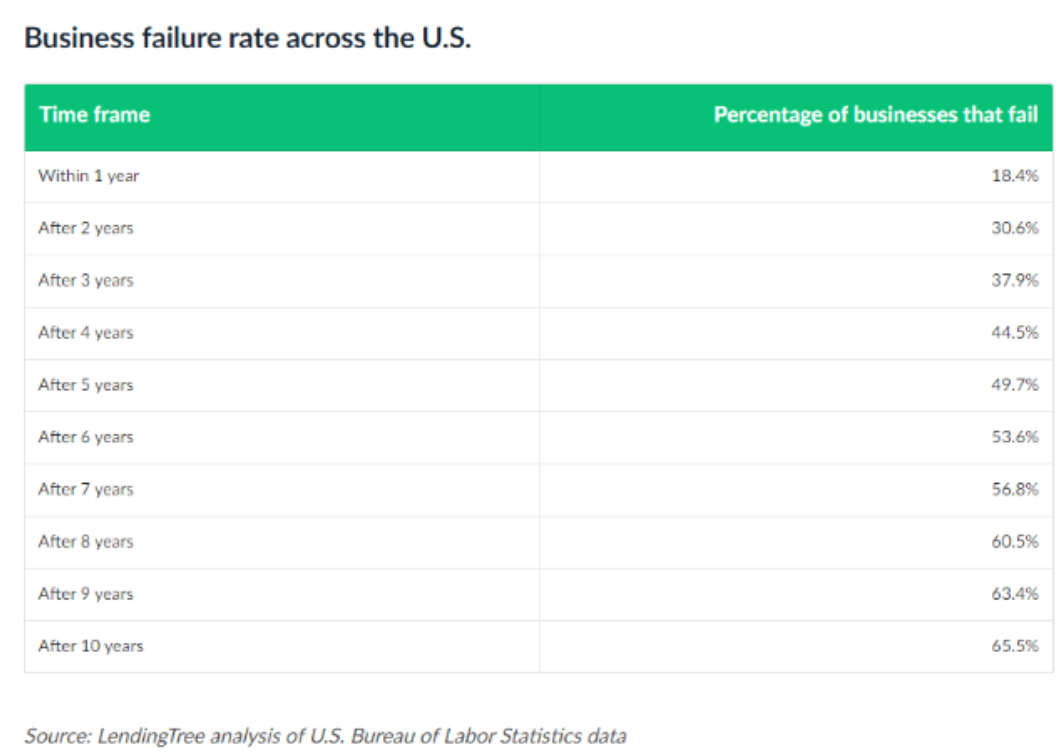

Business success is not easy. And indeed, it is not assured or has anything to do with luck. The odds are stacked against us as business owners. Preparing for this article, I Googled "Percentage of Business Failures," and the first result was an article by Lending Tree that, in gory detail, went into the failure rate for each year.

At one year, 18.4% of businesses are gone; at 5 years, 49.6% are out of business; by year 10, 65.5% of business owners are looking for another job. You almost have better odds going to Vegas at year 10 (and at least you get free drinks!).

So what is the solution? Why do so many businesses fail?

Here are five key traits that I believe every business owner has to have to be able to make their business succeed where others fail.

Financial Responsibility

The key challenge I find with most new business owners (myself included) is that we get excited at the beginning of our business. Typically we have funding from ourselves, family, friends and we believe we need all the things that a "real" company has. We go out and buy new computers, outfit our home office with new furniture and even worse, sign a 5-year or more lease on office space. All of these things are a death knell for a startup.

One of my heroes in business has always been Jeff Bezos. I have a picture of him over my desk at the beginning of Amazon, working out of his garage with a used (and downright crappy) desk and books piled up around him. In 20 years, he became one of the wealthiest people in the world.

We don't need all the best tools to do our job. My first successful business was T-Werx Coworking. When we started, we made all the classic mistakes. We signed up for the most expensive internet available (which almost caused us to go bankrupt), a commercial copier (that our members used like a print shop) and leased a water purification system that I ended up paying for six times over before canceling the contract. These were just a few of the "Stupid Taxes" I paid before wising up. Fortunately, I did that before the business failed.

One of the biggest things I hear from new Entrepreneurs is that "I am just not a numbers person." If you aren't, you need to find financial help immediately. The first hire I made after my epiphany was a bookkeeper that would hold my feet to the fire. She challenged me to eliminate expenses from my business every month (thanks, Venus). One the things my bookkeeper asked me to read was Profit First by Mike Michaelowicz (https://amzn.to/3A6urNl). This book is a must-read for anyone that wants their business to be successful (more on this book later).

Business Structure

Reading the above heading, I am assuming you are considering whether you should have an LLC or S Corp. Nothing can be further from the truth. While this is important, it is not critical at the beginning of the business. By business structure, I mean that from the beginning, you structure your business as a business.

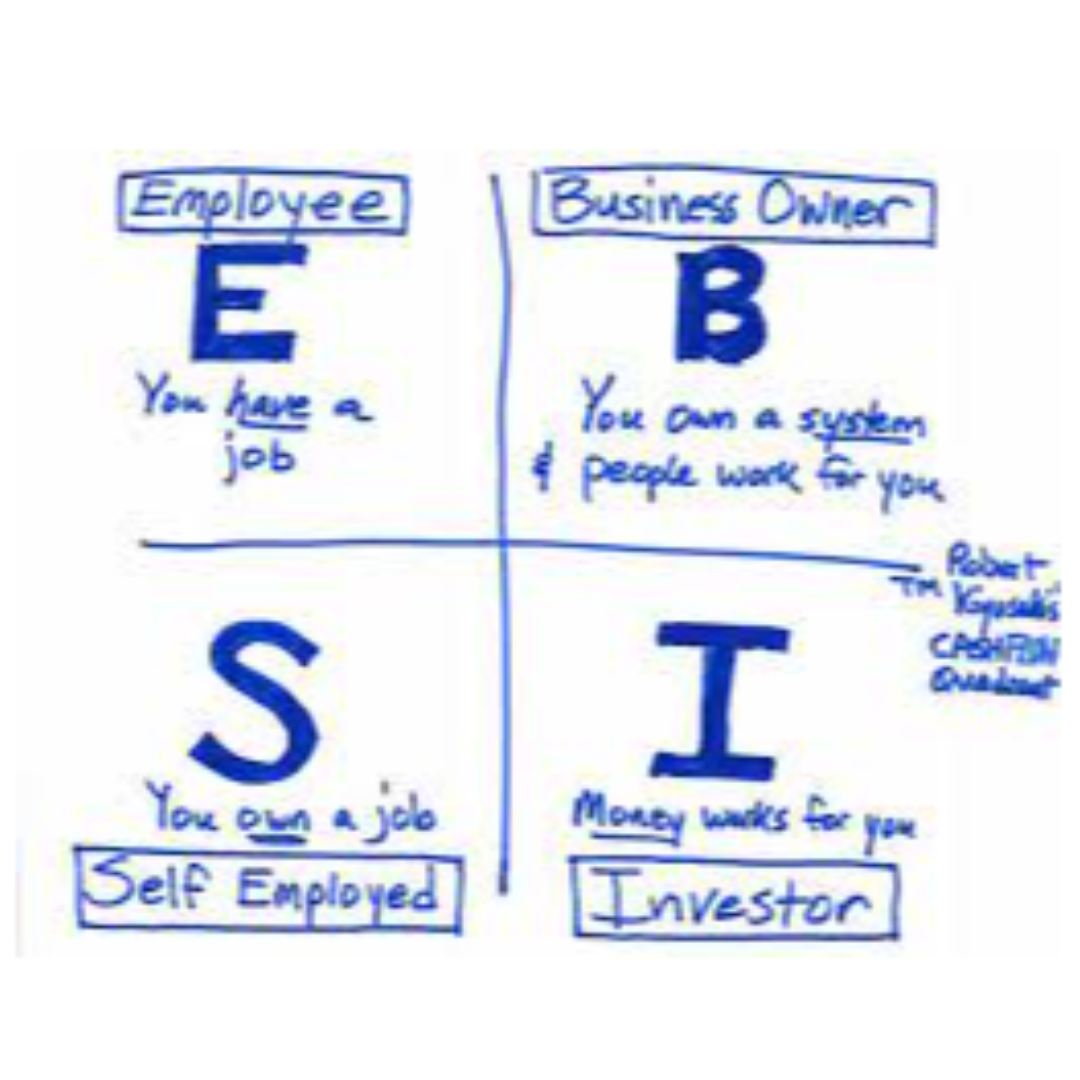

One of the most influential books in my business career has been the Cashflow Quadrant by Robert Kiyosaki (https://amzn.to/3C60T3J).

In this book, Robert lays out four quadrants, called the Cashflow Quadrant, where people fall in their working careers. On the left half of the quadrants are the E's (Employees) and S's (Self Employed). These individuals sell their time for money and their incomes are limited by their available time. The other challenge these individuals have is that if they stop working...no more money.

Contrast this with the individuals on the right-hand side of the Cashflow Quadrant, B's (Business Owners) and I's (Investors). The difference between these individuals is that they are not bound by time. A business owner creates systems in their business and then hires people to work on those systems. Think of the McDonald brothers (the founders of McDonald's restaurants). They were geniuses at building systems and shortening the time it took to serve their customers. It took another entreprenuer, Ray Kroc, to realize the potential, take these systems around the world and make one of the largest restaurant chains the world has ever seen.

The other individual on the right-hand side of the quadrant is the Investor. The Investor takes the money they made (possibly as an E or S) and uses it to invest in things that create a return on their investment without much investment of their time. These investments may be into other businesses, real estate and the stock market. The critical component here is that they focus on investing in things that create cash flow and not speculation (sorry, Crypto "investors").

Pay Yourself

One of the biggest reasons I have seen businesses fail is that the owners run a company where they don't pay themselves. Unless you are independently wealthy (which most of us aren't), you can only go so long before you run out of money. In my experience watching small business owners, this tends to happen in year 2, around 18 months in business and probably explains why the failure rate increases from 18% in year one to over 30% by the end of year 2.

People just run out of money before they run out of the month. I credit my business partner at the beginning of our business for setting aside money each month for us to get paid. At the company's inception, we didn't make much but at least it was enough to survive on and then since that point (over the next six years), we have increased our income each month.

Profit and Owner's pay are core tenants of the Profit First Book by Michaelowicz. You must prioritize and set aside money from the business's income in an "Owners Income" account before you begin paying expenses. He has two other accounts you set up and funnel cash to before paying expenses. This forces your business to run lean and ensures you don't live in poverty.

What are you setting aside in your business every money for profit? Start with 1% of your company's income coming in each month and put it into another account that you can't reach right away. Even a $20 profit per quarter is better than many businesses.

Vision

Vision is a critical trait we as entrepreneurs need to have or we will never succeed. I want to stress real "Vision" here and not just Goals. There are way too many people out there selling programs that spout the same useless information about SMART goals. As my friend Jim Cathcart puts it in his book The Power Minute: Your Motivation Handbook for Activating Your Dreams & Transforming Your Life (https://amzn.to/3BTeUlk), "When setting goals, you must stretch (and sometimes scare) yourself and your vision; otherwise, they are just a task list."

Vision is what gets you through the touch times in the first few years of the business. Vision also helps us to stay focused as entrepreneurs. What we do best is find problems that we can fix and find solutions to solve these problems. Unfortunately, what we do worst as entrepreneurs is find problems and try to find answers to fix all of them (regardless of whether we should). Don't get me wrong, I am a major offender. In twelve-step programs, they say that the first step to recovery is admitting you have a problem.

"Hello, I am Jeff and I chase squirrels."

I challenge you to set some goals in your business and in life that show real vision. Make them specific and measurable but also make sure that they scare you a bit.

Tenacity

The final trait that every business owner has to have is tenacity. Lack of perseverance is the one thing I have seen watching other business owners over the last eight years as an entrepreneur. When things get hard, it is surprising how many people just quit.

In the summer of 2017, I reached a breaking point in my business and personal life. It was our first summer in the coworking business when I realized that entrepreneurs don't like to work in the summer so they did not need a space to work. That worked great for them but I still had rent and bills to pay. Combined with this, I had just started my financial practice with my partner and we couldn't take any income. My income went to virtually nothing overnight.

I remember coming home to my wife Crystal (who was not yet working in the business) and telling her that I could not figure out a way out of our situation. We had a difficult discussion about shutting down our Coworking space through tears. I realized at that point that we owed allegiance to the people that had taken a risk to join an unproven business and we had to figure out a way to make it.

I started to look for every way I could to generate revenue. I drove Uber, delivered food, did business plans for startup businesses and many other things we won't discuss. Many days I worked from 4 am to 9 pm and every weekend day for at least 8-9 hours a day. Most weeks, this amounted to 80-90 hours a week. I did this for over nine months. During that time, our businesses began to grow enough to replace that income.

What can you learn from my story? If you want something, figure out a way to make it happen no matter how hard it is. In my case, I drew on what I learned as a young paratrooper on road marches, lean into your ruck and take one step at a time.

What can you draw on in your experience to keep your tenacity up when things get tough?

Conclusion

While there may be other things that can make you a business survivor, I believe every business owner must have these five traits to succeed. You should address these things at least once a month in your personal life and business. I challenge you to be the survivor statistic instead of the small business victim.

Jeff Kikel is the Founder and CEO of T-Werx Coworking and the Founder of the Freedom Day Method (™). Through his Podcast (Freedom Nation) and YouTube Channel, Jeff shares his wisdom on reaching Freedom Day (™) and an optional work lifestyle. He is the author of 6 books on Retirement, Identity Theft and Entrepreneurship. Jeff's 7th book Freedom Day: Quit the Job You Hate and Live the Life You Love, is due out in September 2022.